Record low interest rates, a strong government economic response to COVID-19 and the potential simplification of lending rules present a golden opportunity for young professionals looking to build their wealth in the long term.

For homeowners, leveraging debt for the purpose of growing your wealth through debt recycling could be one of your most important strategies for accumulating wealth, and it also may present tax advantages. Find out more…

For young professionals with disposable income, the ability to lock in mortgage interest rates for three to four years at less than 2%[1] not only creates an opportunity to repay your home loan faster but could also be an opportunity to recycle your debt and build your wealth through investing.

Proposed reforms to the National Consumer Credit Protection Act 2009 (with the amendments commencing in March subject to legislation being passed) may also potentially simplify lending rules and support lending tailored to the needs and circumstances of individual borrowers.

So what is debt recycling?

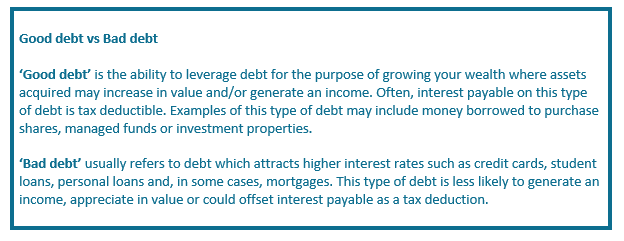

Debt recycling is a wealth accumulation strategy where you pay down your mortgage and redraw from the equity in your home for the purpose of investing. It is a continuous process of replacing, or recycling, the debt in your mortgage (non-deductible or ‘bad debt’) with debt associated with an investment loan (deductible or ‘good debt’).

Debt recycling can be especially worthwhile during periods of low interest rates where investment returns are likely to be higher than loan repayments.

Benefits of debt recycling

This strategy is about using an investment loan to invest in income producing assets, with the income used to pay down your mortgage (until you pay off your mortgage completely), leaving only the deductible debt associated with your investment loan.

Debt recycling can be beneficial to building your long-term wealth, as investment assets are likely to generate an income and may also have tax advantages. While your home may appreciate in value, it does not generate an income and you cannot claim a tax deduction on interest associated with your mortgage, whereas interest payable on investment debt is tax deductible. Debt recycling builds your overall wealth and can also result in increased tax deductions each year.

What you need to know

Debt recycling is not for everyone and it is recommended for people who are disciplined when it comes to saving and utilising spare disposable income. You will need to consider your income and cashflow required to cover loan repayments. The costs associated with refinancing or investment loans also need to be taken into consideration. There may be other wealth accumulation or debt reduction strategies that are more appropriate for your stage of life or circumstances.

One of the most important strategies for accumulating wealth is to start investing early. The sooner you start, the sooner you will start to benefit from the power of compound interest. Even a modest capital investment can significantly build your wealth over time.

At Wealth Fundamentals we specialise in financial strategies for Young Professionals. If competing financial priorities or poor financial habits are preventing you from getting ahead, or you would like to make the most of opportunities for wealth accumulation, we encourage you to contact us on 07 3720 1299 or email admin@wealthfundamentals.com.au to arrange an obligation-free appointment to help secure your financial future.

Lane Moses Pty Ltd ABN 56 092 186 117 trading as Wealth Fundamentals and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.

The information (including taxation) contained within this document does not consider your personal circumstances and is of a general nature only - unless otherwise stated. Wealth Fundamentals strongly suggests that you should not act on it without first obtaining professional advice specific to your circumstances. This information is based upon our understanding of legislation at the time of writing. Such legislation may be subject to change.

This publication cannot be reproduced in any form without the express written consent of the author.

[1] Lowest 3-year fixed rate 1.75% https://www.finder.com.au/the-average-home-loan-interest-rate